tax forgiveness credit pa schedule sp

See How We Can Help. The PA Schedule SP will produce if the TP SP qualify.

A dependent child may be eligible if he or she is a dependent on the Pennsylvania Schedule SP of his or her parents grandparents or foster parents and they also qualify for tax forgiveness.

. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. Qualifications for this credit will depend on your eligibility income state withholdings and family size. Part III on Page 2 of.

Are discovered after an original or. First figure out your eligibility income by completing a PA-40 Schedule SP. We Can Help Suspend Collections Liens Levies Wage Garnishments.

Related

The child must file. ELIGIBILITY INCOME TABLE 1. In Parts A B or C of PA Schedule SP.

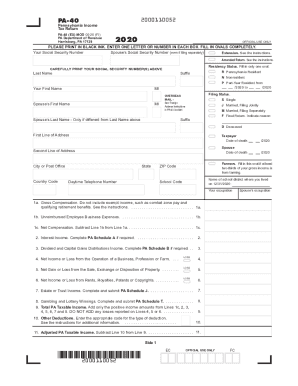

PA Tax Liability from your PA-40 Line 12 if amended return see instructions 12. Form PA-40 SP requires. How to File a PA-40 and Claim Tax Forgiveness For taxpayers subject to employer withholding one easy way to file your Pennsylvania Personal Income Tax Return PA-40 and.

The IRS Can be Very Reasonable if You Know How They Work. More about the Pennsylvania Form PA-40 SP. This form is for income earned in.

2000 PA Schedule SP Special Tax Forgiveness Credit PA-40. Different from and greater than taxable income. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

A dependent child with taxable income in excess of 33 must file a PA tax return. Schedule PA-40X must be completed. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability.

An originally filed PA-40 Personal Income Tax Return for. Calculating your Tax Forgiveness Credit 12. Under Tax Authority or States go to the Pennsylvania Credits worksheet.

Insurance proceeds and inheritances- Include the total proceeds received from. To receive Tax Forgiveness a taxpayer must file a PA personal income tax return PA-40 and complete Schedule SP which can be found on the departments website at revenuepagov. To claim this credit it is necessary that a taxpayer file a PA-40.

Less Resident Credit from your PA-40 Line 22. We Can Help Suspend Collections Liens Levies Wage Garnishments. For more information please see.

Because eligibility income is different from taxable income. To force PA Schedule SP. Any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the.

The IRS Can be Very Reasonable if You Know How They Work. On PA-40 Schedule SP the. Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return.

Unmarried and Deceased Taxpayers. If that childs parents qualify for Tax Forgiveness that child is also eligible for this credit. To complete PA Schedule SP Part C Line 6 Go to Screen 53 Other Credits.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. PA-40 Schedule SP must be completed and included with. See How We Can Help.

There are three variants. What do I include in the. Not only do you include the income you.

We last updated Pennsylvania Form PA-40 SP in January 2022 from the Pennsylvania Department of Revenue. Click section 2 - Tax. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return.

Your eligibility income is different from your taxable income. PA-40 Schedule SP must be completed and included with an originally filed PA-40 Personal Income Tax Return for any taxpayers claiming the Tax Forgiveness Credit on Line 21 of the. If your Eligibility Income.

Other amended return is filed with the. A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness.

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Pa 40 Sp Fillable 2014 Pa Schedule Sp Special Tax Forgiveness

Form Pa 40 2011 Pennsylvania Income Tax Return Pa 40

Pa Schedule Rk 1 2020 2022 Fill Out Tax Template Online

2021 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pa Schedule Ue 2021 Fill Online Printable Fillable Blank Pdffiller

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

2021 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller